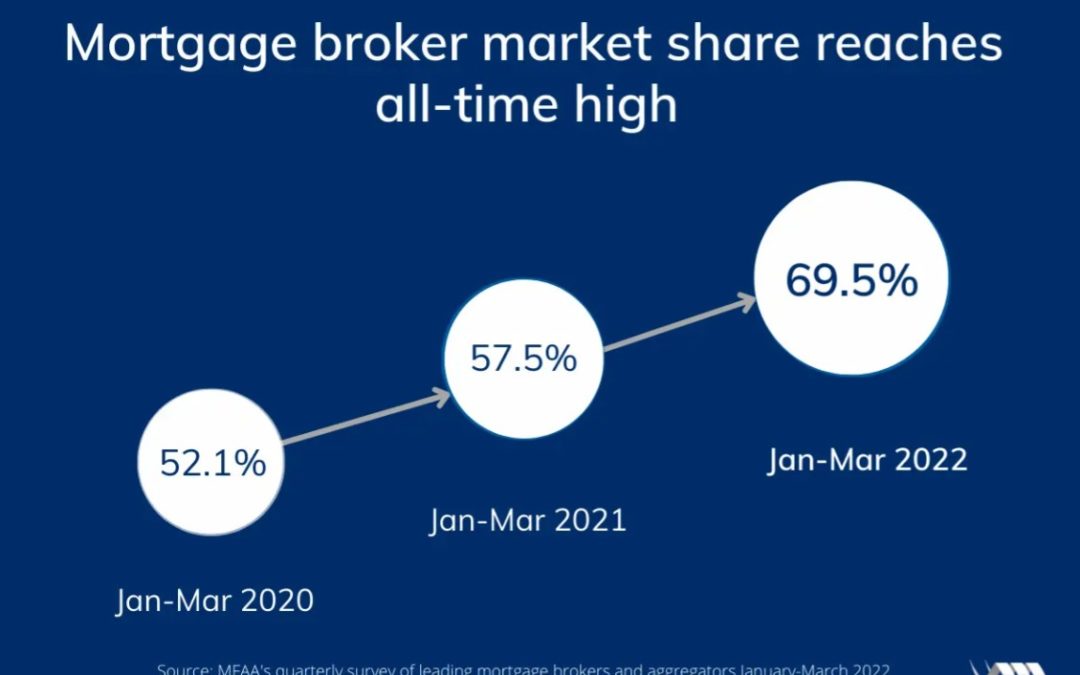

Broker market share rises to record 69.5%. Australians are continuing to turn to mortgage brokers in record-breaking numbers.

In the March quarter, brokers organised 69.5% of all new residential home loans, according to new data from research group Comparator. That is a record market share for brokers.

More Australian homebuyers are accessing the assistance and expertise of mortgage brokers than ever before with the latest industry data showing mortgage broker market share has reached another all-time high.

In the March quarter of 2022, mortgage brokers facilitated 69.5% of all new residential home loans, according to the latest data released by research group Comparator, a CoreLogic business, and commissioned by the MFAA.

This is the largest market share observed to date across all quarters and is a 12 percentage point year-on-year increase on the 57.5% reached in the March 2021 quarter, and a 17.4 percentage point increase on the 52.1% recorded in the same quarter in 2020.

During the March 2022 quarter, mortgage brokers settled loans to a total value of $88.10 billion. This is the highest value of new settlements observed for a March quarter and represents a 41.54% year-on-year increase on the $62.25 billion settled in the same quarter in 2021.

MFAA Chief Executive Officer Mike Felton said the results are indicative of a strong, successful and rapidly growing industry that has successfully implemented meaningful reforms over a number of years and has the trust and loyalty of consumers.

“Not only does the consumer benefit from the significant choice, experience, and convenience offered by a mortgage broker, but on home loans taken out since 1 January 2021 they have been protected by an unrivalled best interests duty, further differentiating the channel and providing yet another compelling reason to use the services of a mortgage broker.

“In a rising interest rate and cost environment, mortgage brokers are exceptionally well placed to assist customers in finding a fairer deal that is in their best interests,” said Mr Felton.

Comparator compiles quarterly broker statistics for the MFAA by calculating the value of loans settled by 18 of the leading brokers and aggregators as a percentage of ABS Housing Finance commitments. The MFAA releases these statistics each quarter. This data can only be used publicly by referencing the MFAA as the owner of the data and its use in communications.

If you need more information about becoming a mortgage broker and need an inspiring mortgage broker mentor, look at Sue Hayter’s exciting website www.melbournemortgagebrokermentor.com.au

Love your life ❤️

Love your business❤️

Reference

https://www.mfaa.com.au/news/mortgage-broker-market-share-breaks-records-again