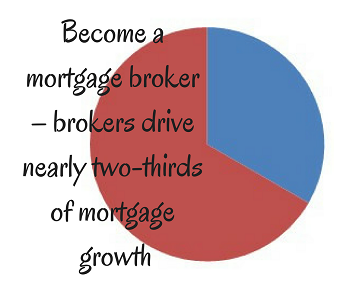

According to research group comparator mortgage brokers were responsible for 61% of the growth in the mortgage market comparing FY 2013 and FY 2014.

The research commissioned by the Mortgage and Finance Association of Australia (MFAA) showed that of the $57 billion increase in mortgage lending in ABS Housing Loan statistics, brokers accounted for $35 billion. The total business attributable to brokers was $142 billion for FY 2013/14, an increase of 32%.

“The 61% contribution to growth is testament to the tide of consumer attraction to the broker channel” commented MFAA CEO Phil Naylor. The data shows the broker market share for the quarter at 49.7%, just under the 50% benchmark of the previous quarter.

MFAA CEO Phil Naylor was pleased with the result. “The broker channel achieved a positive benchmark last quarter and it is good to see that this high level has been maintained throughout this period”, he stated.

“The research also shows that mortgage brokers are offering the consumer real choice and driving competition; 26% of broker initiated loans went to smaller lenders, which attracted only 18% of directly sourced loans” he added.

The MFAA issues these figures each quarter with research group comparator calculating the quarterly loans transacted by 19 aggregator groups as a percentage of ABS Housing Loans statistics.

The Mortgage & Finance Association of Australia (MFAA) is the peak body representing professional finance brokers (including mortgage and finance brokers, mortgage managers, and aggregator/broking groups), to assist them to develop, foster, and promote the mortgage and finance industry in Australia.

If you are in Melbourne and need more information on how to become a mortgage broker, mentoring & business support for your mortgage broker career or you need a mortgage broker mentor, take a look at our exciting website https://www.melbournemortgagebrokermentor.com.au/career/#businesssupport